How to Send Annual Tax Statements to Your Donors via Donately

Follow the steps below to ensure your donors receive their annual giving statements promptly for tax purposes.

As you wrap up the financial year and begin preparations for a successful year ahead, one crucial task is sending out annual tax statements to your donors. Donately makes this process simple and efficient. Follow the steps below to ensure your donors receive their annual giving statements promptly for tax purposes.

Step-by-Step Guide to Sending Annual Tax Statements:

- Log Into Your Donately Dashboard

- Navigate to the 'Tasks' Section

- Once logged in, look for the Settings header in the left column of your dashboard.

- Click on the “Tasks” option located under this header.

- Initiate the Auto-Send Feature

- Click the button “send year end tax receipts” to initiate the auto-send feature for Annual Giving Statements.

- Next, confirm you’d like all donors who supported your cause in the previous year that have an email on file to receive. That’s it!

- Click the button “send year end tax receipts” to initiate the auto-send feature for Annual Giving Statements.

What Happens Next?

After you have set up the auto-send feature, your donors will automatically receive a notification. This notification will guide them on how to access, save, or print their Annual Giving Statements from their donor dashboard. These statements are designed to be clear and comprehensive, making it easy for your donors to use them for tax purposes.

Need Assistance?

We understand that you might have questions or require assistance during this process. Our support team is ready to help you with any inquiries or issues you might encounter. Reach out to us through our help center, or connect directly through our support chat (found in the bottom right corner) Our aim is to ensure your experience is seamless and efficient.

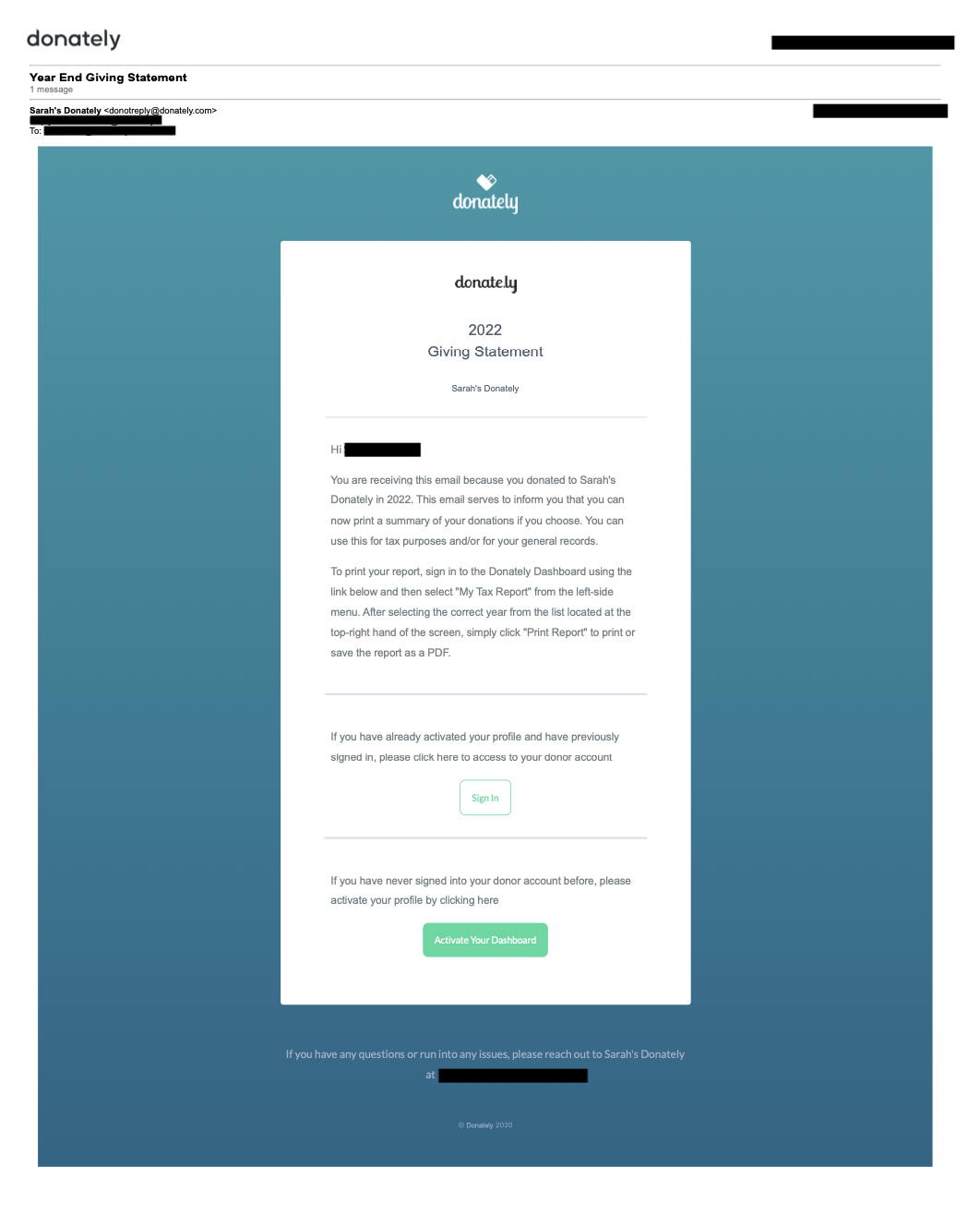

Sample Donor Email Received:

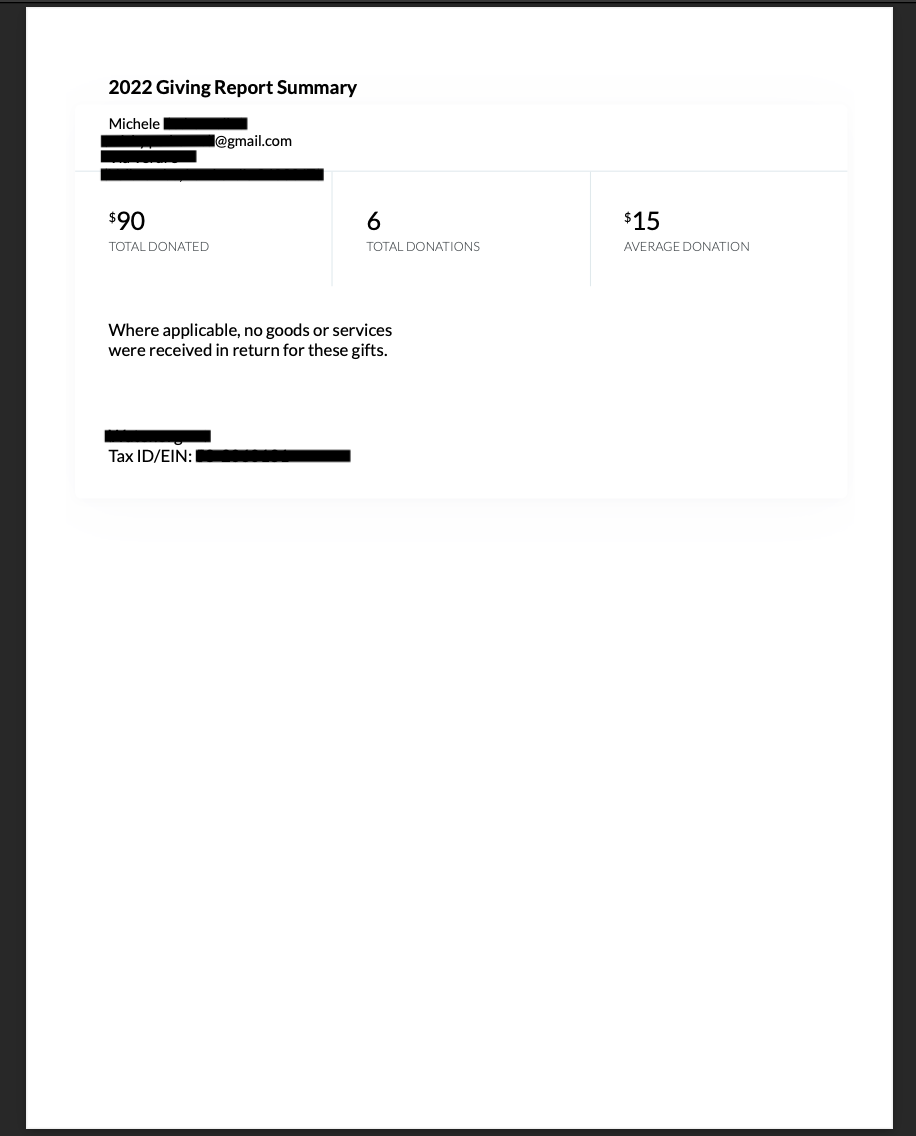

Sample Donor Annual Giving Report: